Bridging the Gap Between Retirement Planning and Healthcare Strategy

At Tactical Wealth Planning, we specialize in guiding pre-retirees and retirees with $1M to $5M+ in assets through the complexities of healthcare and retirement planning.

Healthcare-Integrated Retirement Planning

Unlike most financial advisors who avoid healthcare planning due to its complexity, we integrate healthcare expense planning with retirement income strategies and your investment portfolio. Our synchronized approach ensures you have a plan that supports both your lifestyle and rising medical costs so you can retire with confidence.

Who's Our Ideal Client

At Tactical Wealth Planning, we work best with proactive individuals who want to eliminate the stress and uncertainty of not having a well-structured healthcare plan integrated into their financial future. Our ideal clients understand that healthcare costs and aging-related medical needs can significantly impact their financial well-being. They seek guidance not only in managing their investment portfolio but also in planning for potential medical expenses, early retirement healthcare solutions, and advanced healthcare decisions.

They value a holistic approach to financial planning one that ensures they are prepared for both the financial and qualitative aspects of aging, giving them confidence and peace of mind about their future.

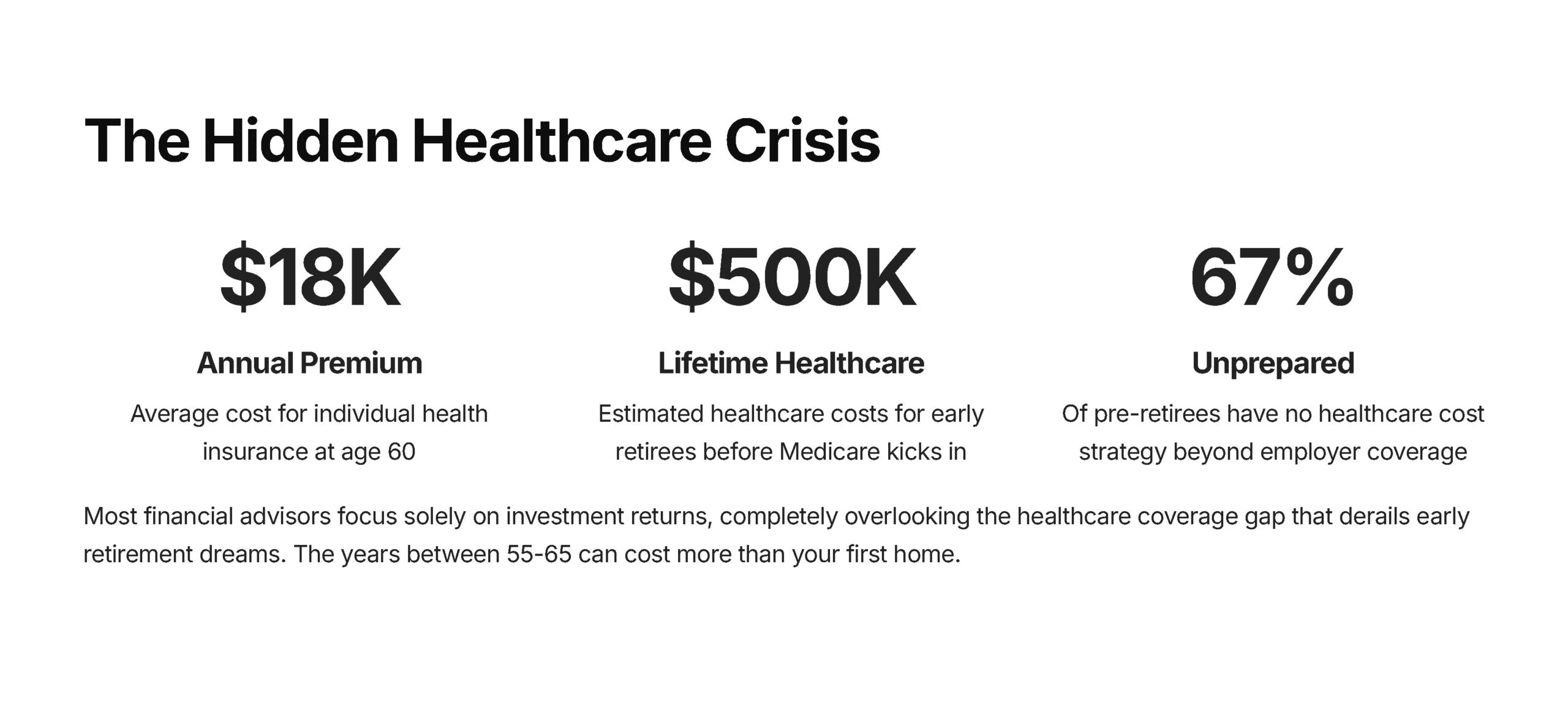

Ready to retire at 55–60 but healthcare is in the way?

Executives and successful professionals often have the wealth to retire early — but rising healthcare costs can delay the decision. We create strategies to bridge the gap and protect your lifestyle.

Approaching 65? Medicare isn’t the whole plan.

If you’re preparing to retire just before Medicare, the transition can feel uncertain. We help you navigate Medicare choices and plan for healthcare costs in retirement — so medical expenses don’t erode your savings.

Healthcare is the missing piece in early retirement.

Rising medical costs before and after Medicare can quickly drain savings if not planned for. We integrate healthcare strategies directly into your financial plan — giving you confidence and protection for retirement.

What We Do

Medicare Guidance & Enrollment Support

We simplify Medicare so you can make informed choices with confidence. One-on-one guidance, clear explanations, and answers tailored to your unique situation.

Healthcare Expense Integration

Healthcare is one of the most underestimated and rising costs in retirement. From Medicare premiums to out-of-pocket expenses, healthcare can significantly impact your retirement income and long-term financial stability.

Early Retirement Healthcare Solutions

Solving the issue of healthcare coverage and expenses prior to age 65.

Investment Management

Custom portfolios inclusive of models, tax-loss harvesting, direct indexing, fee reduction.

Retirement Income and Cash Flow Planning

Creating tax efficient withdrawal strategies that supports your day-to-day life and adjusts for inflation, taxes, and unexpected expenses.

Legacy and Estate Planning

Develop a continuity plan for your assets and your family.

Tax Planning

Reducing your retirement tax bill and optimizing healthcare expense tax strategy.

Our Services & Fees

Why Tactical Wealth Planning

Tactical Wealth Planning: Where Health Meets Financial Clarity

Tactical Wealth Planning bridges the gap between financial security and health care clarity—because true peace of mind in retirement comes from knowing both are covered. Click the picture below to learn more.